Project Freeman Phase 3: Implementation

The 3 Tests of Lawful Rebellion

If The State shows that is does not abide by its own 'laws', stop paying tax in Protest so as not to fund the State's illegal wars

Background

'A Freeman' first reported the UK Government War Crimes in March 2009. As of now (May 2011) no action has been taken by the UK authorities we reported the crimes to.

There is more hope via the ICC in The Hague, who at least are "considering" 'A Freeman's' allegations

In the meantime Stage B-1 of the strategy has been implemented and tax with-held in protest. The 'Make Wars History' campaign suggests that all UK citizens should withhold INCOME tax until the UK's illegal wars are ended. However, 'A Freeman' found it was a bit more than just Income Tax involved...

As we saw in the Constitution section of Phase 1 (Evaluation) of this project, the original 1215 Magna Carta contained articles where the free men (Barons) aimed to limit the power of The Crown (legal fiction) to tax them by stopping what they considered 'unfair' taxes (of course in practice they simply passed this duty on to the poor serfs!)

So, in Freeman ideology some taxes are considered more fair than others. Let's consider the various types of taxes:

This is a tax which once collected is allocated specifically to expenditure related to the reason for the tax and therefore distributes the benefits of the tax fairly amongst everyone. e.g. you would assume that 'road tax' as we informally call it (actually called 'vehicle license tax') would be allocated to spending on roads. Unfortunately this is not the case

A levy (or duty) is a tax charged indirectly via the usage of a certain item. e.g. duty charged on beers, wines, fuel etc. This is the fairest type of tax of all as the users of the item have a choice as to how much of the item they use, and therefore how much tax they pay, or even whether to use the item at all. (Of course, it's difficult these days NOT to use fuel!). As far as we can tell originally all taxes used to be of this nature but over the years, via its statutes, the State has imposed more and more un-apportioned taxes on its citizens

Taxman!

Taxes are collected by HMRC (Her Majesty's Revenue & Customs)

but allocated by HM Treasury

(don't forget that 'Her Majesty' is of course a legal fiction, in this case a 'corporation sole')

Action

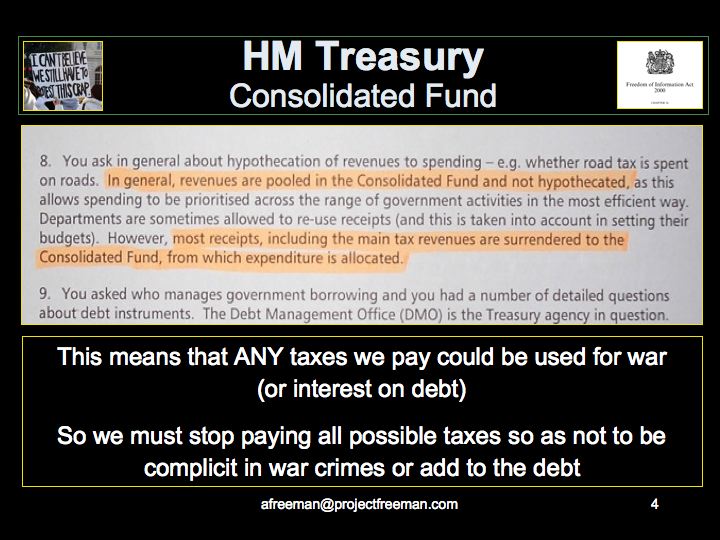

We wrote to HM Treasury to find out how our taxes are allocated.

They confirmed that "...the vast majority of taxes are allocated to the consolidated fund and are drawn by the government as they see fit..."

(see Freeman of Information for details)

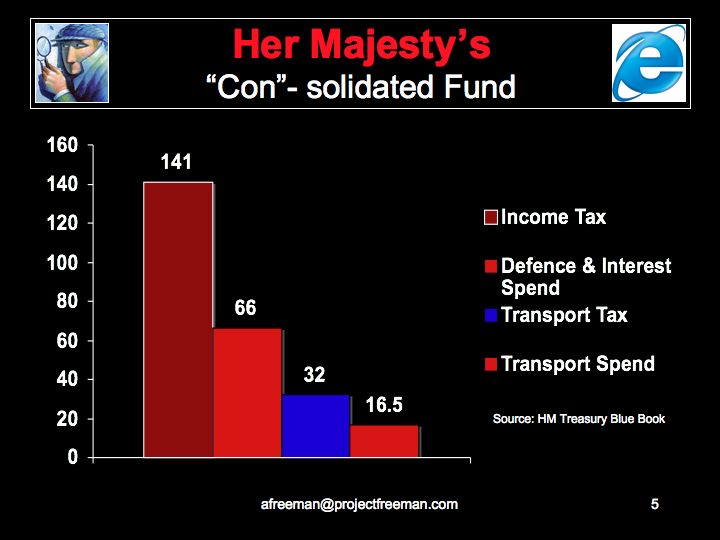

This 'Con'-solidated Fund approach gives our Servants lots of flexibility to use our money for things we may not agree with as you can see in the slide above

The figures are from 2009 and show that although they collected £32Bn in transport related taxes that year only £16Bn was allocated to transport related spending.

But the real issue as far as this project is concerned is that £66Bn of the £141Bn collected via Income Tax (i.e. 47%) is spent just on the Her Majesty's Armed Forces and Interest on Her Majesty's Debt. By 2011/12 this situation had of course got even worse with OVER half of Income Tax (£90 Billion!!) being spent on these two items (see Her Majesty's Finances for much more on this).

This of course means that if UK citizens want to be sure that they are NOT funding war (or interest on debt to the bankers for that matter) they need to stop paying ALL taxes that are paid into the consolidated fund as there is no way to know which monies are allocated to what!

So this is what 'A Freeman' decided to do. This meant serving notice on the 3 main government agencies involved.

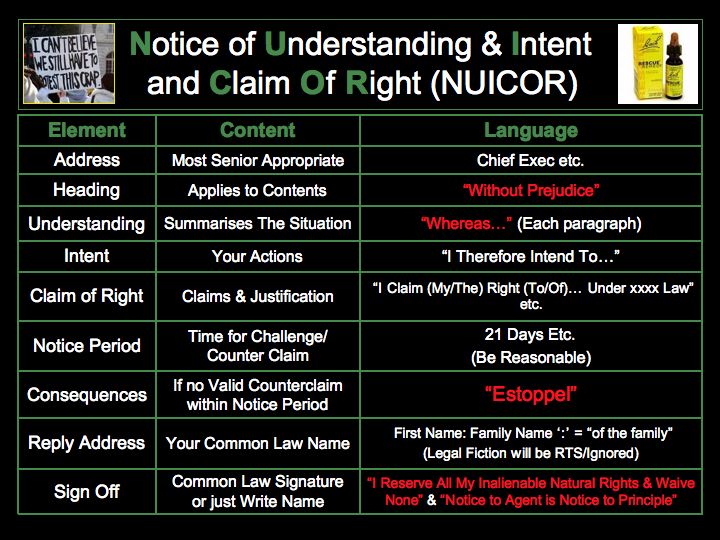

This was done via a 'Notice of Understanding, Intent & Claim Of Right (or NUICOR for short)

(Thanks to Robert, Arthur : Menard for 'A Freeman's' education regarding these notices)

Below are the essential elements of a 'NUICOR' ...

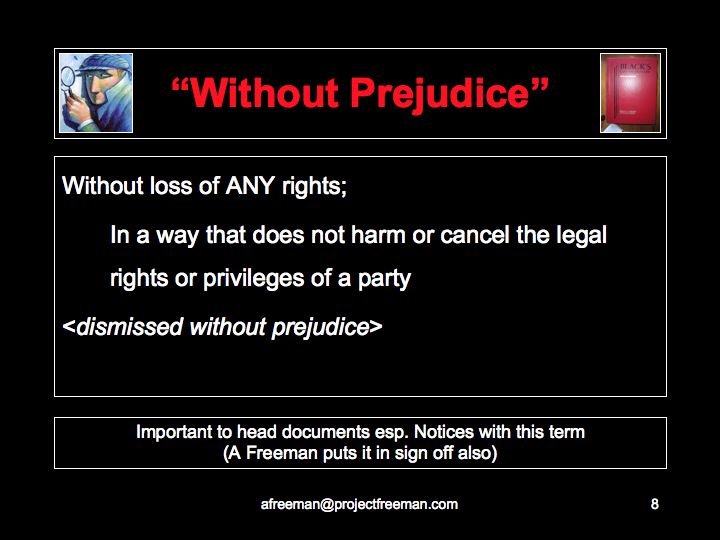

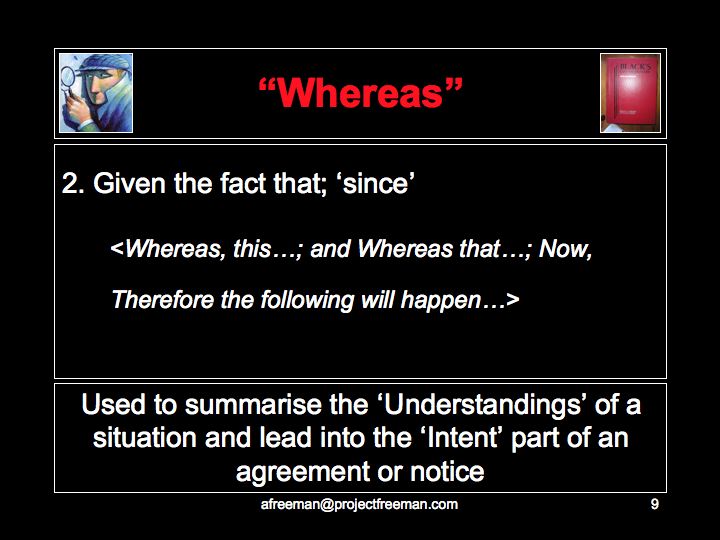

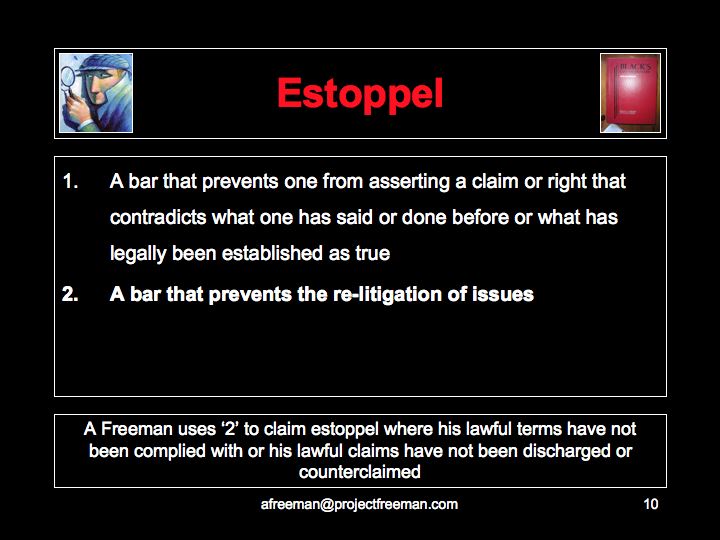

... and the 'Legalese' definitions of some of the terms you may not be familiar with:

There is a web page link for each of the 3 main Notices served; below in the summary of 'A Freeman's' actions.

Each tax is classified as Direct (D), Indirect (I), Allocated (A), Un-allocated (U) or Levy (L)

Summary of Tax Remedies

* Although this Notice process started in Jan 2010 'A Freeman' had previously given Notice in May 2009 that he would not be filing tax returns until he received his Income Tax & NI payment records. See the 'Freeman of Information' page for details